Showing posts with label economics. Show all posts

Showing posts with label economics. Show all posts

Monday, 9 September 2024

Tuesday, 31 May 2022

Friday, 1 October 2021

How Much Does It Cost To Smash The Economy?

Australian Billionaire Clive Palmer asks if the police wish to interview him, he's available.

He's referring to Gladys Berejiklian the NSW Premier who is the boss of Kerry Chanter, who made the New World Order speech. Gladys is in the pockets of Big Pharma to the tune of millions.

How are the Police and the Judiciary controlled?

Senior Masons - I'm not talking about the porch monkeys who are self liquidating by vaccinating themselves.

Tuesday, 27 October 2020

You'll Own Nothing, and You'll Be Happy - World Economic Forum

I have mentioned in the past, that paradoxically I agree with a lot of NWO agenda. An example is that surely we shouldn't be fighting each other, but instead discovering the universe, forming partnerships and exercising our rights that have been removed without our consent?

The only caveat is that I'm OK with some of their plans, but only if the rulers, or people in charge, have a positive agenda for humanity. Sadly that isn't the case so I'm obliged to resist, until such time as the current leadership have been replaced.

It's worth repeating again, that the reason for the Scamdemic is to implement 'The Great Economic Reset'. Those you who haven't noticed that a sixth (or even a fifth in some circumstances) of the high street is currently in receivership, are going to find my claims a lot harder to digest.

The video above by the World Economic Forum, introduces the notion of a non materialist life. This is a value I concur with, but once again, if it's driven by the enemies of humankind, it means nothing to me.

What do you think?

Thursday, 24 September 2020

Sons of Light vs Sons of Darkness - The Great Economic Reset

Around about the beginning of 2020 a fellow researcher and long time friend noticed that "The Great Awakening", and similar proclamations by Q of QAnon fame, echoes a lot of New Age literature embedded in the Lucis Trust that has Consultative Status with the Economic and Social Council of the United Nations (ECOSOC).

The Lucis trust initially named Lucifer Publishing Company, was established by Alice and Foster Bailey in May 1922 and proselytises the Luciferian argument that Lucifer is the provider of light despite being cast down by God as a former angel.

The more I looked into this argument the more evidence I found, and my friend's thesis (which I'll be sharing more of in greater detail) developed into a simple dialectic which, he claims, will mean the forces for good (Trump et al) will vanquish the forces of darkness (Hillary et al) and then present the post Covid-19 world population with an economic Faustian pact that will reset the economy, introduce a global cryptocurrency (meaning the end of the petrodollar), and provide a Universal Basic Income for all people, unable or unwilling to find rewarding work.

Put simply my friend's research implies that both sides are controlled and even after one side has imploded, the same power will be in place, but widely perceived as 'the good guy', thus precipitating a New Economic Model.

I'm a Q researcher and probably know more than anyone I've met in real life on the subject, so while I'm not fully convinced of the impending outcome of the 'sons of light versus sons of darkness', I will know the signs to confirm my friend's research (which is largely historical bloodline and tribal/secret society movements) and I will know when to concede if I'm wrong.

I've done enough research to confirm the economic reset is coming, but now it's a case of waiting out for the Faustian pact part of the deal, which will result in a new world order as outlined by Aldous Huxley and Orwell.

Vaccines for everyone, stunted IQ, plummeting sperm counts, and a two tier society where no questions are asked and control is absolute.

We shall see about that, but one things is already in the bag.

Nothing will go back to the way it was.

A change I welcome.

Update 9/11/2023: Genocider Netanyahu has been spitting children of light vs children of darkness tweets to justify the ongoing genocide in Gaza (False flag hybrid event) AND THEN DELETED THEM.

Rishi Sunak was tweeting Divali Celebrations on the triumph of light over darkness'. But that's impossible while Israel controls UK domestic and Foreign policy with Sunak and Starmer competing over who can grovel hardest during a seismic and irreversible shift in global sentiment. Out of touch, out of ideas and absent the necessary courage to stand with the people against genocide.

And if you're still in denial about what is going. Allow me to leave you with the team who lit the fuse with 29 drops on Dark to Light. Here's the last drop on the subject dated June 3rd (3/6) 2020

..and here's the the first drop by the Q psychological operation on Dark to Light.

That was dropped on 11/11. I wonder if we'll see some changes on Remembrance weekend?

Saturday, 24 December 2016

Are Federal Reserve Interest Rates About To Rise Markedly?

I'm the first one to put my hand up and admit I've spent to much time with Clif High over the years because though he got so much wrong, he did nail Margaret Thatcher's death and Hillary's collapse on 9/11 which keeps me checking in on his work.

However, despite many missed forecasts and an industrial case of confirmation bias, this is his best interview for a long time and I enjoyed listening to it.

It's enjoyable even for just entertainment value, though I did make the effort to study long term interest rates and I think the image I've used above is indicative of the change that the Webots are claiming.

Friday, 25 January 2013

Monday, 15 October 2012

John Kenneth Galbraith on the Moral Justifications for Wealth and Inequality

A 1977 documentary series written and hosted by John Kenneth Galbraith. This segment, “The Manners and Morals of High Capitalism,” discusses how the rising bourgeoisie and the new rich justified their lofty status. Kings could rely on God and the Great Chain of Being for their authority, but what about mere capitalists? Galbraith reviews the views of some of the leading defenders of this new order, and shows how their ideas have influenced our views.

Galbraith makes quite a few deadpan observations and gently pulls apart the social Darwinism that permitted the wealthy to be the innocent beneficiaries of their own superiority.

Via the excellent Naked Capitalism

The Age of Uncertainty is a 1977 television series about economics, history and politics, co-produced by the BBC, CBC, KCET and OECA, and written and presented by Harvard economist John Kenneth Galbraith.

Galbraith acknowledges the successes of the market system in economics but associated it with instability, inefficiency and social inequity. He advocates government policies and interventions to remedy these perceived faults

The content of the series was determined by Galbraith, with the presentation style directed by his colleagues in the BBC. Galbraith began by writing a series of essays from which the scripts were derived and from these a book by the same name, emerged which in many places goes beyond the material covered in the relevant television episode.

Labels:

capitalism,

economics,

greed

Tuesday, 28 August 2012

Ex MI5 WhistleBlower @AnnieMachon - Libya Was Bombed For Reasons Of Greed

Around the 10 or 11 minute Ex MI5 Annie Machon takes us through the Libyan leader wanting to disengage from the Petrodollar. Who could blame him? The West is printing worthless money and pointing a gun at countries that don't want to accept it. It's immoral and I hope you have a viewpoint on it because at some point the next city to be on the end of an RAF airstrike to keep your standard of living the same will be on the corporate media news.

Thursday, 12 January 2012

Infographic: How Much Money Is Printed To Save The Western Perpetual War/Central Banking Model?

The liquidity injections tell you everything you don't want to know. We're insolvent and our holographic fiat currency is propping us all up at the expense of the poor. We''re predatory around oil countries (Libya and Iran), and I say morally bankrupt. The full story is over at the Financial Times.

The comments below the article refuse to ask the 64 cent question.

How much keyboard tap money can the fiat currency/federal reserve/central banking model take?

We're going to find out.

The comments below the article refuse to ask the 64 cent question.

How much keyboard tap money can the fiat currency/federal reserve/central banking model take?

We're going to find out.

Wednesday, 11 January 2012

Targeting Israeli Apartheid: Boycott Divestment & Sanctions (BDS) Handbook

Grown up, calm and sensible measures for rehabilitating Israel back into the global community through financial pressure. It would take a lot less effort than many would believe. Like most bullies its a house of cards living in fear.

This requires empathy not hate. Firmness not harshness.

This requires empathy not hate. Firmness not harshness.

Thursday, 24 November 2011

All Watched Over By Machines Of Loving Grace

Earlier, Mark pointed me to the ever interesting Adam Curtis' blog who reminds us that the Greeks have a lot more street-savvy awareness of elite rip-off techniques including rapid power swaps that we most memorably experienced when blue blood Alec Douglas Home needed to dump his title to run the UK after the Suez crisis.

Or as The New Statesman puts it:

Or as The New Statesman puts it:

We British look complacently on the installation of Mario Monti and Lucas Papademos as unelected leaders of Italy and Greece respectively. Couldn't happen here, we say. But in 1963, when Harold Macmillan resigned, our unelected Queen, advised by mostly unelected Tory elders, sent for the unelected 14th Earl of Home and made him prime minister. He subsequently renounced his title, changed his name back to Douglas-Home and won a by-election in a safe Tory seat conveniently vacated for him. All that was stitched up in weeks.

I like Adam Curtis but I've not followed his latest work. He's not sussed out why 9/11 happened which makes me squirm a bit. Nevertheless I started to watch the first episode of Machines of loving Grace, and I remembered that he has a brilliant BBC film library at his disposal and a good enough brain to adumbrate a point of view that while not flawless is able to provoke new thoughts in my own. He also digs up bits of history I wasn't aware of. I knew of Alan Greenspan's Randian worship and I'm familiar with her work, but I didn't know he was part of her swivel eyed private circle. The lens on this period in New York was fascinating though once again we're reminded that the people who really took over the US after the first coup d'etat of Kennedy's death were all subsequently installed during the Ford presidency.

I put it to you that the people (string pullers/banksters) really in power used the Nixon downfall to set up a clique of players including Rumsfeld, Cheney, Wolfowitz, Perle and Greenspan to set up the game for later down the road. They cut their teeth during the tail end of a volatile period and then returned with a neoconservative agenda of nitrous oxide shock doctrine debt capitalism, false flag opportunism and empire expansionism under the quintessential puppet president. George Bush 43.

Brilliant really. We've been schooled by the best. If we get through this rollercoaster to the end we'll have picked up some very useful lessons in spotting the finest manipulation, trickery and mendacity in the galaxy.

These will be essential skills to ensure the empire can never strike back to anywhere near the effectiveness they once had.

Wednesday, 28 September 2011

It's Not Man Flu Till You've Watched This

Haven't got three whole minutes and thirty whole seconds? It's girl flu. Get back to your work. (However this trader is wrong in his assumption that capitalism is eternal. It's a hundred year or so aberration and is on its way out)

Labels:

capitalism,

economics,

greed

Sunday, 7 August 2011

Black Swans & Fallen Angels

If you haven't read The Black Swan by Nassim Nicholas Taleb it's the most erudite permission-to-believe-in-the-unexpected book I've read. Intellectually it opened up my mind to the potential of radical possibility and so I started to think my analysis of Capitalism might have some validity and rejected the whole model of senseless consumption via fiat currencies, floated on derivative trading, lorded over by globalised slave labour while hacking down forests, depleting oceans and strip mining mother Earth's crust.

His first book Fooled By Randomness is in my opinion an even better read but the reason for posting this tonight is I believe that an overdue economic collapse is under way. I know I said that in 2008, and yes it was premature (and wishful thinking, the dollar is one tough cockroach) but I wasn't wrong about the unquestioned venal greed of the system.

All around the world ordinary people are increasingly uncomfortable with a paradigm that is destroying the planet, poisoning our environment and fuelling a superficial worship of materialist-science as saviour, slavish tech-fetishm and contemptuous poverty-blindness. It's a religion with it's own callous Gods no superior to the Jehovahs of the old Testament.

I don't know if tomorrow is going to be the long overdue market bloodbath of a system that isn't sustainable but I welcome its impending demise, and the potential for transformational change in how we see ourselves as a species and the planet as a living being.

If anyone in Bangkok wishes a hardback copy of the The Black Swan, I have a hard copy I've read twice and no longer need.

Wednesday, 27 July 2011

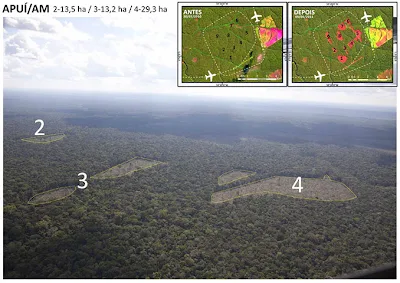

Stunning Amazon Brand Infographics

Depressing story. Do we really need another social media plan for M&M's or [insert brand of your choice here]. It's not just the Amazon. It's all over the world the corporations are stripping Mother Earth bare. Madagascar looks to be having a particularly brutal time.

Wednesday, 22 June 2011

Why I Want Quantitative Easing 3 (QE3)

I belong to a small group of informal tinkerers, thinkers, speculators, information terrorists and oddball lunar(tics) who suspect that Barack Obama is the most interesting occupant of the Whitehouse ever. I accept he's not delivered on key promises but this is a war we are in, and earlier promises are casualties of timing not commitment.

It wouldn't be helpful at this point in time to be more explicit but there are bits and pieces of mainstream academic theory and commentary that currently provide circumstantial evidence for the theory that dare not speak its name.

That's weird, I just realised we never ever say what it is we suspect. Just point at stuff that makes sense. It sounds very cliquey and I suppose it is.

Anyway, I read about the social theorists that Barack Obama based his masters dissertation on, and realised it was the most awesomest bad ass idea I've come across in over forty years of thinking about better ways for our planet and species. The idea behind the paper is nothing short of how to torpedo the good ship capitalism before it sails off with every last mineral, flora and fauna that is our obligation as a species to use frugally and share without profit for the collective good. I am good-to-go with QE whatever it takes till the parasite of capitalism finally keels over and sinks.

Thursday, 2 June 2011

How Significant Is Investment Within An Economy?

Paul Denlinger's answer on Quora:

In the US there are many opinions about exactly what is investment, but I will try to give some examples.

In a developing economy with undeveloped infrastructure, it is very important. Basically, investment is the money spent which will create jobs and add to the country's GNP (gross national product). I am most familiar with China, and when China opened up for reforms in 1978, the country was, for all practical purposes, bankrupt. Fortunately, many ethnic Chinese business people from Hong Kong and Taiwan invested in factories to make light goods for export. In the beginning this was not much, but as workers saved more money, they were gradually able to buy more for themselves and their families. This led to a virtuous cycle and over 30 years, the standard of living for almost all Chinese has dramatically increased.

The opposite of investment is consumerism, where money is spent, but does not add value for anyone, or increase GNP. The classic example for mindless consumerism is the US. This is because not only have people spent money to buy things which don't add value, they have actually borrowed money to do it. This adds to the costs of money because they need to pay interest for the use of the money. No wonder the US middle class (or what is left of it) is in such a pickle!

In the US's case, investment involves spending money on those things which will enhance the US's competitiveness in the global economy. If you look at it in those terms, spending on foreign wars, a grossly over-expensive and broken healthcare system which coddles the healthcare providers and insurance companies at the cost of most Americans doesn't make sense. The list goes on and on. Every time I look at the spending choices Americans make on the individual, city, county, state, and national level, I just end up shaking my head.

Another way of defining investment is "What will add to the value of a person, city, county, state or nation over a period of time?" Frequently this means deferring immediate pleasure, but realizing the added value later. The biggest enemy of investment is time because in a democratic society, people want results NOW. Most good investment decisions don't realize high returns immediately. An example: if Warren Buffett had to listen to his investors in his early years, most likely he would not have made the high returns he is now famous for. This is a basic failing of most democracies.

To get back to answering this question, investment is absolutely essential to an economy, regardless what stage of development it is at, esp if it is going to be competitive on an ongoing basis. Many western govts, with the help of investment banks, have gone deeply into debt in order to win voters, but have ended up cutting needed investment for their own economies.

Now, they are waking up and paying the price. This cost comes in the form of money paid over to the investment banks in the form of interest; this is money which rightly should go to future generations so that the economy can become more competitive in a global economy.

What a mess!

Monday, 13 December 2010

Charles Krauthammer

I try to spend as much time as possible finding opinions that disagree with mine and that are substantive. I wouldn't want people to assume that I'm a knee jerk leftist even though I stand totally against the corrosive effect that Fox news has on the American people. I also don't like Hannity as like O'Reilly he's an unpleasant bully. He makes it so easy to forget that when interviewing erudite company he can raise his game a little, though he's most certainly not Copernicus. Don't even get me onto CNN's toothless dog.

However here are two of my pet hates and Charles Krauthammer, who I think like Clinton and Obama are still ignoring the intellectual pre-industrial economic mammoth in the room. Robert Reich (who is demonstratively brilliant) probably thinks like I do but I totally disagree on his economic purism timing. I sense he misses the arena. Seeing Bill and Obama on his old sparring ground yesterday. This isn't surprising but it is most definitely human and forgiveable.

Though straight after this should there be some kind of disclosure that doesn't pop the system? *

Yeah. Go for it. Tell the American people why 2 trillion in the bank lends no succour and that the Pentagon and black hole budgeting CIA are both largely pernicious anachronisms and would best be merged into some sort of post industrial think tank/incubator/global relief mechanism hired out to the U.N at fair rates.

After all, those anonymous chaps have already run the globe ragged through domination by neo-liberal failed shock doctrine economics. It's also purely State owned so if that kind of unthinkable thinking were to happen, I'd get to call it what it really is neo-Marxism for the 21st century. That's the Kafkaesque world I'm forced to live in.

Anyway. Fox and reasonable analysis...Blow me.

* Personally I say pop the system but I'm more resilient than most and don't have as much baggage to weep over. However that's not a particularly fair basis when considering others, and it's a bit more complex than yay or nay.

Saturday, 9 January 2010

How Great Thou Art

This work filmed in New York reminds me of a conversation I heard repeated recently between an American and a Pakistani sometime in the late 60's or early 70's I guess. The American, squashed in the back of the pedal powered cab listened as the Pakistani driver said.

"You see, we here in Pakistan understand the problem. Progress he exclaimed! Progress is the problem".

It sounded funnier in audio but it touches on a some thoughts I've had recently and which I've no answer for. However this is the second piece of art in a week which gives me permission to hope that maybe our artists are emerging from an understandable but frustrating inertia of everything goes, compounded by never quite leaving when its time was up.

Too early to call but this work is not inconsequential is it?

The flip side of the progress coin is a dawn shot of New York that someone tweeted the other day, and which left me in no doubt of the city's prowess as the definitive skyline of progress.

It's this that awes me about New York. On weird days the abstract creativity of Wall Street spits in my gravity cautioning face. But for the record. I'm anti gravity.

Sort of.

Wednesday, 2 December 2009

How To Fix Capitalism

The recession and the crisis and banking are the least of the reasons for thinking that we need reforms. the crisis of capitalism goes much deeper: the influence big business has on governments (and the warped policies this leads to), increasing central control of the economy and the general move away from free markets.. I have some modest proposals on how to fix capitalism.

Break up monopolies and oligopolies

Under existing competition (anti-trust in American) laws, it is necessary to prove abuse of the monopoly. This allows a business to avoid competition, because it has not been proved to have used particular practices. Competition may be locked out (for example, by network effects) and consumers may suffer from a lack of innovation or product quality, but none of that is illegal.

The solution is to assume that monopolies are harmful and should be broken up. Either this should be an invariable rule, or it should be up to the monopolist to prove that the monopoly is somehow beneficial. An exception should be made for natural monopolies, but the price of that should be tight regulation, nationalisation, or (best of all) mutualisation.

That still leaves the problem of oligopolies. The answer is simple: break up any company with enough market share to have a noticeable influence on prices — say more than 5% nationally or 10% at a city/county level. Again, they would need to make the case of exceptions.

Doing this would also mean that there would be no "too big to fail" banks, so a financial crisis would be easier to solve: let them go bust and nationalise the assets and liabilities.

Remove barriers to entry

Abolish patents. They have not been proven to speed progress: the evidence seems to be to the contrary. They definitely increase costs, are an inefficient way of funding R & D and allow oligopolists to block competition.

Reduce the copyright term to the optimal length suggested by research of about 15 years. It ought to be obvious that works produced in the reign of Queen Victoria should not be in copyright in the 21st century.Exclude works distributed with DRM from copyright to ensure that copyright works do fall into the public domain when the copyright expires. Reduce the copyright term on computer software to two years, and make copyright contingent on disclosing source code (so others can alter the software when it comes out of copyright). Abolish region of origin rules. It should be legal to describe a Cava (when selling it) as having been made in the same way as Champagne. Abolish unnecessarily restrictive licensing. Many US states require people to be licensed to work as interior designers or hairdressers. I can understand requiring doctors or auditors to be licensed, but these are just barriers to entry.

Reduce bureaucracy

The best example of the problem (or opportunity from his point of view) that I have heard, is something Ted Tuppen, the founder and CEO of the huge British pub chain Enterprise Inns, said. I may not have got the wording exactly right, but, as I remember it, it was:

There will always be pubs available to buy because owners of free houses are driven out of the business by the amount of bureaucracy.

Small businesses cannot cope with tight regulation. Big businesses can hire teams of lawyers and paper-pushers. This is one of the many problems with patents. The government, far from discouraging oligopolies, is actually encouraging their formation.

Stop being "business friendly"

People seem to be thinking much less clearly about this now than they did in the 18th century. Back then, the business friendly ideology was called "mercantilism", and this was the primary source of opposition to free markets. Now, governments profess to be in favour of free markets and "business friendly".

Of course, businesses sometimes want free markets, for example they do not want to regulated. On the other hand they also want to minimise competition, reduce costs, receive subsidies and form cartels. Businesses are usually in favour of free markets in general, but not in the specific case of their own industry.

The new mercantilism is the root cause of the problems most of my other proposals seek to solve. It has also lead to a failure to regulate properly. The obvious examples are the clear failures in the regulation of banks (such as allowing deposit takers to have high risk investment banking operations), but there are others: the US broke up Standard Oil and AT & T, but failed to break up Microsoft, reflecting the general trend towards letting businesses do as they like.

New mercantilism has dropped the one aspect of the 18th century form that I find has some redeeming features: economic nationalism. Democracy is compromised by the economic pressure tyrants can bring in a globalised economy. I also find it extremely odd that governments will minutely examine an applicant for a holiday visa, but allow a dubious foreign tycoon to gain great influence within their country by buying influential businesses.

New mercantilism is dishonest. It does not openly oppose free markets. Instead it relies on conflating free markets with capitalism.

Financially penalise large businesses

This idea is simple. Tax big companies more. This will discourage mergers except where there are clear gains. British tax law already has lower rates for small companies, but this does not go far enough. The rates should keep increasing as companies get larger (at the moment there are no further increases on companies with profits greater than £1.5m: I would suggest bands at say £15m, £150m and £1.5bn as well). Obviously, we would need similar systems in all major economies.

The size criteria should not be based on profit. It should be based on value added: so a big company that has a bad year would not see its tax rate reduce (obviously taxes paid would do down in proportion to profit).

Give shareholders control

Shareholders are supposed to the owners of a company, but in the case of large listed companies this control is limited. This does lead to problems:

Shareholders have to resort to expensive and disruptive means such as accepting hostile takeover bids to replace incompetent management — this also tends to encourage consolidation where there is no real economic benefit. Management have an incentive to focus on the short term. They can take their bonuses and leave, while accumulating problems for the future. Management tend to overpay themselves. As J.K. Galbraith said: "The high salary of the chief executive of a large corporation is not a market reward for achievement. It is frequently in the nature of a warm personal gesture from an individual to himself." Management indulge their egos, buy engaging in exciting takeovers, and risky businesses, rather than getting on with the humdrum but reliably profitable. It is impossible to prove what people were thinking, but it is hard not to believe that this contributed to the destruction of GEC/Marconi

Reject the corrosive "greed is good" ideology

Adam Smith never intended that the idea of the "invisible hand" should be interpreted as meaning that people should pursue their own interests, and that this would lead to an optimum outcome. He wrote extensively on morality.

The reason for those troublesome bonus schemes for directors is that it is assumed that they would not run the company as well as they could unless they were "incentivised" with payments for success. This contradicts management theory: Herzberg classifies pay as a "hygiene factor", a poor motivator compared to, for example, job satisfaction.

What is even worse is that by telling people that they are expected to be selfish, they become more selfish. Economics students become more selfish because they are repeatedly taught to expect that people are rational and selfish: the association between the two can only strengthen the effect.

Society is permeated, especially in business, politics and economics, with the idea that is people pursue their own interests, this will automatically lead to the best outcome, and that, therefore, people should be selfish. This cannot be fixed by endless incentives to align interests: life and business is too complex for that to work. A free market is not a substitute for integrity.

Break the loop

What matters most is the rejection of the new mercantilism, which will at least stop things getting worse, but we still need to undo the legislation and the structures that have been put into place at the behest of the mercantilists. The two go together: the rise of the new mercantilism is partly the result of the lobbying power of large corporations. Break them up and reduce their power and they lose their influence.

Education is also important. Most people cannot, at the moment, distinguish between capitalism and free markets, or see the parallels between the original and the new mercantilism.

Via Graeme

Subscribe to:

Comments (Atom)